5 Life and Money Insights from Charlie Munger

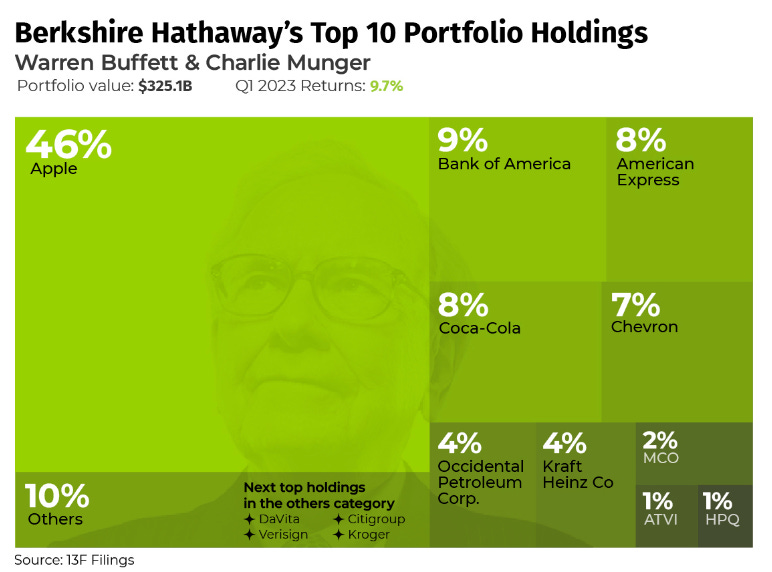

For those of you who may not be familiar Charlie Munger was one of the most successful investors of our generation. He passed away last year November at the age of 99 just 34 days prior to his 100th birthday. Charlie is more well known for his role as the Vice Chairman of Berkshire Hathaway, the company held by Warren Buffett. Munger was Buffett's closest partner and right-hand man, and he played a crucial role as the "architect" of Berkshire Hathaway's business philosophy. At the time of his death, the majority of Munger's wealth was tied to his ownership of 4,033 Berkshire Hathaway Class A shares, valued at $546,869 each on October 5, 2023. This investment would place his holdings in excess of $2.2 billion.

Charlie was famous for his heavy lessons in one sentence and I want to go through 5 of them with you today…

“Acknowledging what you don’t know is the dawning of wisdom.”

Often times the more we learn the more we realize how little we actually know. By recognizing what you don’t know you can tilt the odds in your favour and avoid making costly mistakes. Never forget this quote.

“Remember Louis Vincenti’s rule: ‘Tell the truth, and you won’t have to remember your lies.’ "

The underlying theme here is that having integrity will go a long way. According to a study by the University of Massachusetts, 60% of people can't go 10 minutes without lying. The thing is that lies add up and can get quite expensive. Lying constantly to yourself and/or others is just not sustainable.

“View a stock as an ownership of the business and judge the staying qaulity of the business in terms of its competitive advantage.”

This is one of the main focus points of my stock course. Too often people treat the stock market like a casino, but when you look at it as a market with the opportunity to purchase quality businesses, you’ll probably make smarter decisions.

“Move only when you have the advantage - you have to understand the odds and have the discipline to bet only when the odds are in your favour.”

This is definitely easier said than done and it takes acquired knowledge to execute successfully. I still think its easier than most may think. The key message here is that you are making a decision that is specific to your own goals/strategy. Kind of like a Cheetah patiently waiting till its prey gets close enough to where it can’t escape.

“Life, in part is like a poker game, wherein you have to learn to quite sometimes when holding a much - loved hand - you must learn to handle mistakes and new facts that change the odds.”

Knowing how when to recognize a mistake and correct yourself will result in a more successful result. I look at this as a success and not so much a failure. Never let ego dig an even deeper hole for you.

BONUS: “People are trying to be smart - all I am trying to do is not be idiotic, but it’s harder than most people think.”

I think deep down most of us can look back at things that we did that we’re dumb. Use those moments as guiding principles to avoid doing dumb stuff in the future.

Shoutouts to Charlie Munger for leaving us with so many life gems.

Happy Investing,

Kobi